36+ Principal 401k withdrawal calculator

Not an easy task. Ad Use This Calculator to Determine Your Required Minimum Distribution.

2

25Years until you retire age 40 to age 65.

. The goal of a retirement withdrawal calculator is to figure out how much you withdraw from savings without running out of money before you run out of life. Get a Diversified Portfolio for your Retirement Goalsin One Simple Investment. First how much are your investments presently worth.

This is a very. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and.

All payment figures balances and interest figures are estimates based on the. Ad A One-Stop Option That Fits Your Retirement Timeline. To give you an idea 20000 in a 401 k 403 b or 457 b account could triple in 20 years at an average 7 rate of returnbut not if you withdraw it today.

Traditional IRAs and 401ks are two of. 401 k Calculator. Withdrawing 1000 leaves you with 610 after taxes and penalties Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan.

Early withdrawals from IRAs or 401ks are both subject to a 10 penalty along with standard income taxes. You decide to increase your annual withdrawal by 35 and want the money to last for 35 years with nothing left for heirs after that time. Use this calculator to estimate how much in taxes you could owe if you take a distribution before retirement from your qualified employer sponsored retirement plan QRP such as a 401k.

To calculate your investment withdrawal amount for this year well need to answer a few questions. Planning Tools Calculators Find useful tools and resources for tracking your savings progress estimating your coverage needs and taking control of your financial future. A savings account is a bank account where you can keep your money securely and earn some interest in the meantime.

Our Assumptions To get the most out of this 401 k calculator we recommend that you input data that reflects your retirement goals and current. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Percent of income invested. You will find the savings withdrawal calculator to be very flexible. Your employer needs to offer a 401k plan.

Ad Estimate The Impact Of Taking An Early Withdrawal From Your Retirement Account. While banks typically offer a lower return on savings. Add up all of your income.

While it is most frequently used to calculate how long an investment will last assuming some. You should consider the retirement withdrawal calculator as a model for financial approximation. 1 IRS annual limits for 2022.

The calculator will calculate any one of four unknowns. Enter 0 zero for one of the four and a value for each of the other three. Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA.

2

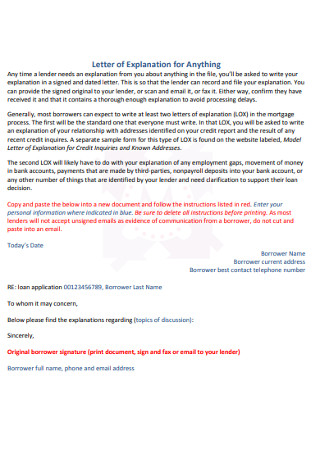

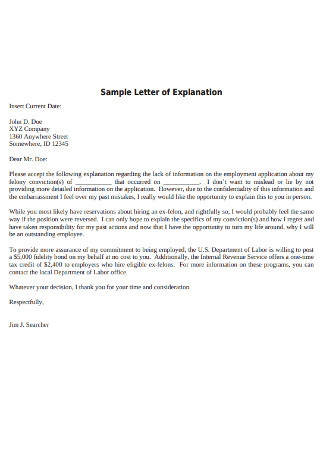

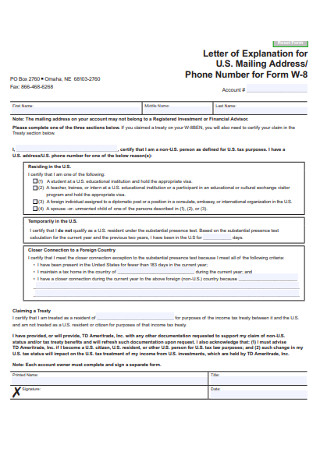

36 Sample Letter Of Explanation Templates In Pdf Ms Word

36 Sample Letter Of Explanation Templates In Pdf Ms Word

36 Sample Letter Of Explanation Templates In Pdf Ms Word

2

36 Sample Letter Of Explanation Templates In Pdf Ms Word

2

2

Front Page Accounting Cdr N

2

2

36 Sample Letter Of Explanation Templates In Pdf Ms Word

2

2

36 Sample Letter Of Explanation Templates In Pdf Ms Word

2

Front Page Accounting Cdr N